Governor Charlie Baker published his budget recommendation for state fiscal year 2021 on January 22, 2020. The plan, also known as House 2 (H.2), is the sixth budget proposal developed by Gov. Baker and the second since his re-election in November 2018.

This policy brief summarizes some of the high-level themes of H.2 and raises a series of questions for further review and analysis in the weeks ahead.

Key Takeaways

- H.2 seems to adhere to the spirit of the education finance reform law enacted in November 2019, but more analysis is required to unpack the details of how the changes are proposed to be implemented.

- The Governor’s transportation proposals highlight the problems confronting the state’s transportation system and heighten the importance of efforts like the Transportation Table (T3), which suggested governance changes, new revenue sources, and a comprehensive plan for investing in public infrastructure.1

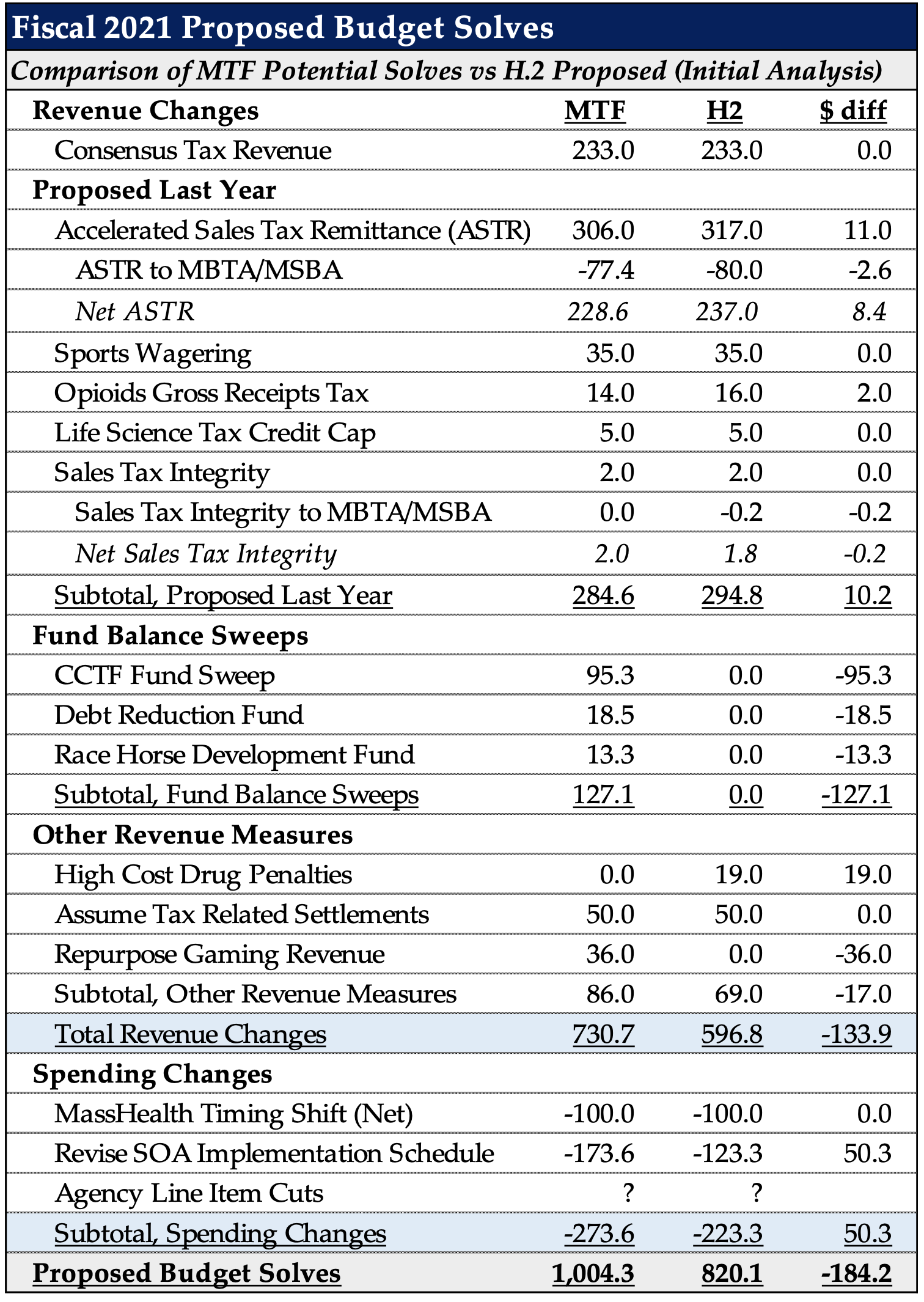

- The governor’s plan appears to include budget solves totaling at least $820 million in fiscal 2021, largely consistent with the starting gap projected by MTF.2

- H.2 relies on $341 million in tax revenue adjustments, most of which have been proposed and rejected in the past. It is unclear how the discussion in the new budget cycle will be different from previous years.

Fiscal Overview

Fiscal Overview

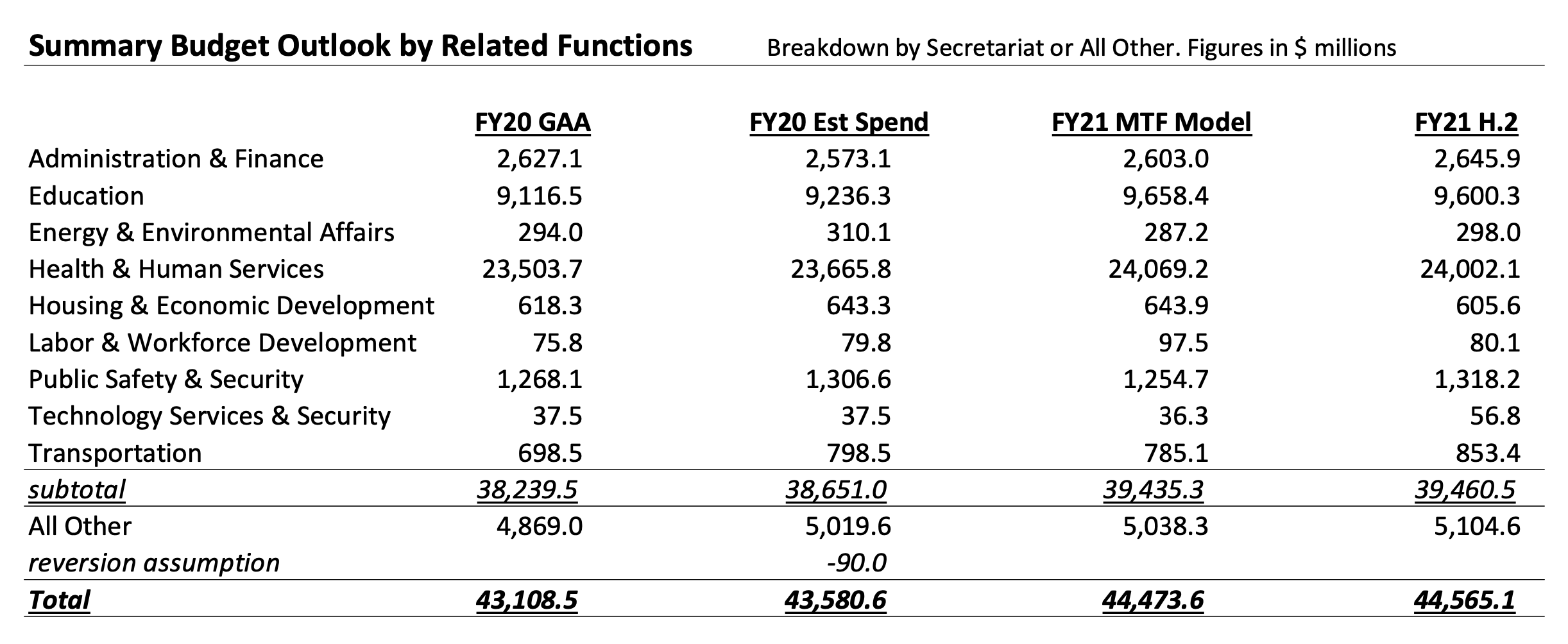

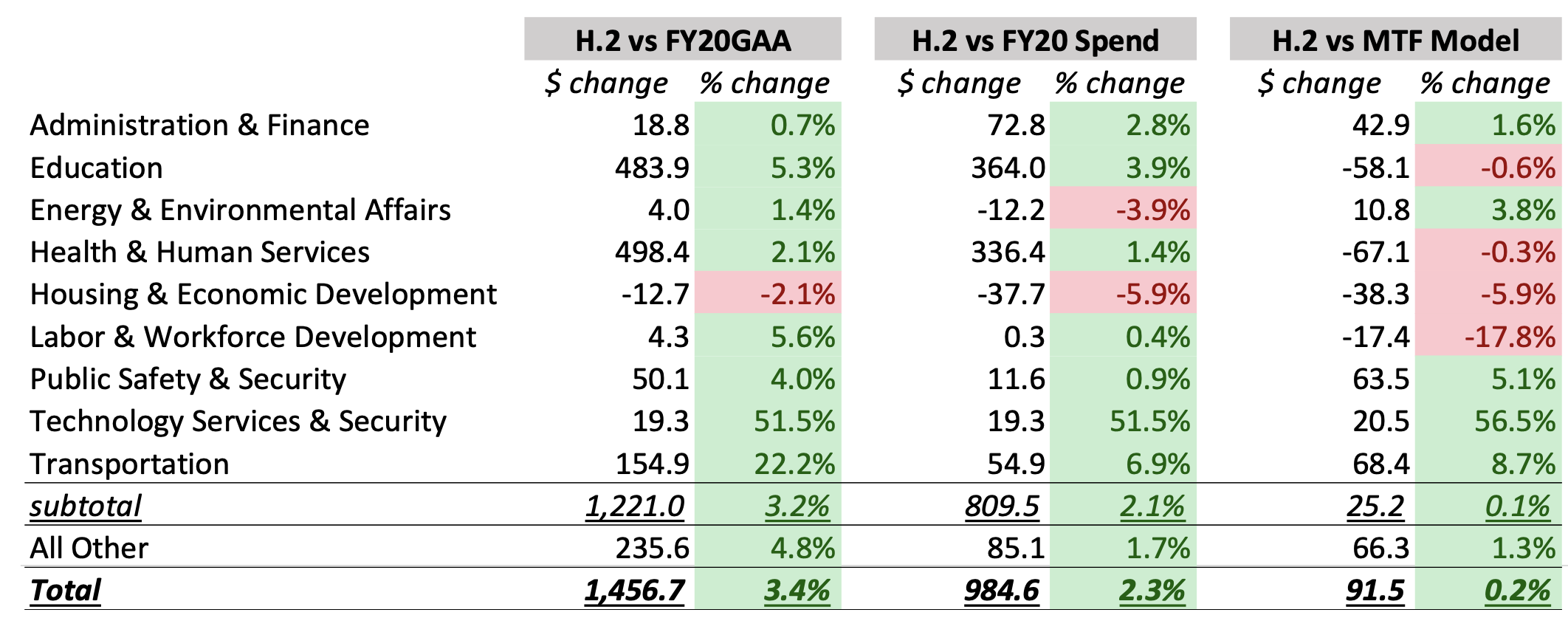

- H.2 proposes $44.6 billion in budgeted spending excluding transfers to the Medical Assistance Trust Fund, pension system, interfund transfers, and chargeback spending, an increase of $985 million and 2.3 percent over fiscal 2020 estimated spending (as depicted on Page 2).3

- The plan includes a deposit of approximately $310 million to the Commonwealth Stabilization Fund, the state’s “rainy day” fund, and is projected to raise the fund balance to $4.3 billion by the end of fiscal 2021.

- The spending plan is supported by the consensus tax revenue estimate of $31.151 billion in tax revenue, implying growth of 2.8 percent over the revised fiscal 2020 tax benchmark and approximately $341 million in tax adjustments, including $317 million from adopting Accelerated Sales Tax Remittance (ASTR) for sales tax collections and a variety of other smaller changes.

- H.2 anticipates $19.3 billion in non-tax revenue, including $12 billion in federal reimbursements (primarily for MassHealth, the state’s combined Medicaid/Children’s Health Insurance Plan program), $4.9 billion from fees, fines, penalties, and other departmental revenue, and transfers from authorities of $2.5 billion.

Highlights from Key Policy Areas

Local Aid & Education

- H.2 proposes $1.16 billion in funding for Unrestricted General Government Aid (UGGA) for cities and towns, an increase of $32 million, or 2.8 percent, over fiscal 2020 levels and consistent with Governor Baker’s pledge to align UGGA increases with projected tax revenue growth.

- The governor’s plan recommends approximately $5.5 billion for Chapter 70, the state’s primary education cost sharing program with school districts, an increase of $304 million or 5.9 percent over fiscal 2020 and adhering to the spirit of the education finance reform law adopted in November 2019.

- H.2 includes approximately $1.17 billion in spending for public higher education institutions, including $571 million for the University of Massachusetts and $598 million for the state university system and community colleges, representing an increase of 1 percent compared to fiscal 2020 estimated spending.

MassHealth & Other Health and Human Services

- Funding for MassHealth, the state’s largest program providing health care benefits more than 1.8 million residents, is projected to increase to $16.8 billion, an increase of $102 million or 0.6 percent over fiscal 2020.

- Net of federal reimbursements, state costs for MassHealth will total $6.7 billion, an increase of $35 million, or 0.5 percent.

- These figures include the impact of “timing shift”, which moves certain MassHealth spending from fiscal 2021 to fiscal 2020 in order to manage costs among fiscal years.

- Other health and human service programs, such as the Department of Children and Families or the Department of Mental Health, will spend nearly $7 billion in fiscal 2021 under the Baker plan, an increase of $237 million or 3.5 percent compared to fiscal 2020 estimated spending. These programs represent an area of the budget that has grown rapidly in recent years.

Transportation

- H.2 includes total support for the Massachusetts Department of Transportation of $548 million, an increase of $78 million or nearly 17 percent over fiscal 2020 levels. This reflects support for snow and ice control costs of $95 million in fiscal 2021, an increase of $40 million over fiscal 2020, $8 million for the Registry of Motor Vehicles, and additional funding for other initiatives related to addressing traffic congestion and other issues.

- The governor’s plan provides nearly $1.4 billion in total support for the Massachusetts Bay Transportation Authority (MBTA), an increase of $135 million or 11 percent compared to the fiscal 2020 GAA. A portion of this increase is the result of a proposal to increase the existing fee on Transportation Network Companies (TNCs) from $0.20 to $1 while another part is supported from additional sales tax revenue assumed from ASTR. This funding is targeted at improving safety and reliability efforts highlighted in the MBTA Safety Review Panel report from December 2019.4 The governor’s proposal represents a reversal of his previous position in opposition to new revenue sources for transportation needs.

- The Governor also proposes to expand and extend the MBTA Fiscal Management and Control Board (FMCB) from five members to seven and allow for municipalities to select a representative to advocate for their interests on the reconstituted MBTA board.

- Regional Transit Authorities (RTAs) are funded at $94 million in H.2, an increase of approximately $4 million and 3.9 percent over fiscal 2020 levels.

Public Safety

- Funding for the Massachusetts State Police totals $413 million in the H.2 proposal, a slight decrease from fiscal 2020 levels for the embattled state agency.

- H.2 includes $711 million in spending for the Department of Correction’s main facility account, representing $16 million in additional spending, or 2.3 percent growth compared to fiscal 2020.

- H.2 also includes $680 million for Sheriffs’ departments across the Commonwealth, an increase of $20 million or 3 percent compared to fiscal 2020 estimated spending and more than $66 million and 11 percent above spending levels approved in the fiscal 2020 GAA, highlighting the significant disagreement between policymakers and the sheriffs about appropriate spending levels.

Debt Service

- H.2 includes $2.6 billion for the Commonwealth’s debt service payments, including an increase of just $9 million, or 0.3 percent, over fiscal 2020 spending levels.

Policy Questions for Further Review and Analysis

- How faithfully does H.2 implement the Student Opportunity Act?

- What are MassHealth cost growth trends on a gross and net basis over time with appropriate adjustments for the impacts of “timing shift” and other management actions?

- How did the Governor solve the projected $880 million starting gap in fiscal 2021?

- What does the future look like for the state’s “rainy day” fund, the Commonwealth Stabilization Fund?

- What does the H.2 proposal imply about the future of legalized gaming in Massachusetts, including both the state’s existing gaming facilities and the potential impact of sports wagering?

- What is the current status of criminal justice reform in Massachusetts?

- What is the current status of efforts to address the Commonwealth’s unfunded obligations related to pension liabilities and other post-employment benefits (OPEB)?

- For more information, see The Transportation Table Overview of Recommendations by the Transportation Table coalition, November 2019.

- For more information, see First Look: Tough Choices Ahead in Fiscal 2021 by the Massachusetts Taxpayers Foundation, January 15, 2020.

- This preliminary spending comparison varies from figures published by the Executive Office for Administration and Finance due to structural differences in calculating total spending in fiscal 2020 and fiscal 2021.

- MBTA Safety Review Panel Final Report. December 9, 2019.