Related to BUDGET & TAXES

- Policy Areas

- Policy Area

Displaying 51-60 of 202

Feb 26, 2024

Publication

Feb 26, 2024

Publication

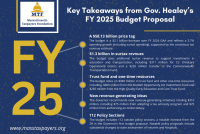

The Healey administration filed its Fiscal Year (FY) 2025 budget proposal on January 24th, totaling $58.13 billion. The spending plan includes critical investments in healthcare and education, as well as a notable funding increase for transportation supported by new income surtax revenues.Governor…

Publication

Feb 23, 2024

Publication

Feb 23, 2024

Publication

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1 billion surtax spending cap established for the FY…

Publication

Feb 14, 2024

Publication

Feb 14, 2024

Publication

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in child care, healthcare, and transportation; as well as sizeable increases in support for local aid to cities and towns and K-12 education…

Publication

Jan 24, 2024

Publication

Jan 24, 2024

Publication

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported by income surtax revenues. The Governor’s budget…

Publication

Jan 11, 2024

Publication

Jan 11, 2024

Publication

Earlier this week, the Healey administration announced a $1 billion tax revenue shortfall for FY 2024, downgrading the revenue benchmark from $40.41 billion to $39.41 billion. They also released a plan to solve the shortfall which includes approximately $375 million in net mid-year (9C) budget cuts…

Publication

Jan 08, 2024

Publication

Jan 08, 2024

Publication

On January 8th, budget leaders from the House, Senate, and Administration announced a $40.202 billion consensus tax revenue figure for the Fiscal Year (FY) 2025 budget, excluding surtax revenue. Budget writers expect tax revenues to grow by $792 million (2 percent) over estimated FY 2024…

Publication

Jan 08, 2024

Publication

Jan 08, 2024

Publication

The Healey Administration announced a $1 billion revenue shortfall, attributable to below benchmark revenue collections to date.The FY 2024 revenue benchmark has been downgraded to $39.410 billion.After accounting for the shortfall and the impacts of tax relief, expected FY 2024 revenue collections…

Publication

Jan 04, 2024

News Item

Jan 04, 2024

News Item

Doug Howgate, the president of the Massachusetts Taxpayers Foundation, said the numbers suggest to him that it’s time for Gov. Maura Healey to revise downward the tax revenue forecast for this year by about $1 billion and begin to pare back spending using her power to make unilateral cuts.

News Item

Dec 12, 2023

Publication

Dec 12, 2023

Publication

On December 4th, the Massachusetts Taxpayers Foundation (MTF), along with the Department of Revenue (DOR) and other economic experts participated in the annual Consensus Revenue Hearing. The hearing offers administration and legislative budget leaders an opportunity to reassess revenue assumptions…

Publication

Dec 10, 2023

News Item

Dec 10, 2023

News Item

Analysts with the Massachusetts Taxpayers Foundation believe the hiring spree in the wake of the COVID-19 pandemic will slow, as will wage and salary growth, contributing to the sluggish withholding tax revenues.MTF and several other economic experts on Monday advised officials to reduce their…

News Item