Displaying 131–140 of 309

Mar 17, 2020

BUDGET & TAXES > Budget > FY 2020

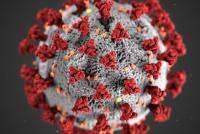

BOSTON – On March 10, 2020, Governor Charlie Baker declared a state of emergency in Massachusetts regarding the Coronavirus 2019 (COVID-19) pandemic and has ordered sweeping measures to slow the outbreak.

BUDGET & TAXES > Budget > FY 2020

Mar 11, 2020

BUDGET & TAXES > Budget > FY 2021

This analysis describes the steps taken by the governor to balance the budget compared to MTF’s initial projection of an $880 million gap between revenue and spending in fiscal 2021. It also describes ten tough choices confronting legislators as they...

BUDGET & TAXES > Budget > FY 2021

Jan 24, 2020

BUDGET & TAXES > Budget > FY 2021

Governor Charlie Baker published his budget recommendation for state fiscal year 2021 on January 22, 2020. The plan, also known as House 2 (H.2), is the sixth budget proposal developed by Gov. Baker and the second since his re-election in November...

BUDGET & TAXES > Budget > FY 2021

Jan 15, 2020

BUDGET & TAXES > Budget > FY 2020

After two consecutive fiscal years of above-trend tax growth and manageable spending increases, an initial analysis of the state’s finances suggests policymakers will face tough choices as they begin budget development for state fiscal year 2021. A...

BUDGET & TAXES > Budget > FY 2020

Dec 04, 2019

BUDGET & TAXES > Budget > FY 2021

Tax revenues will increase by approximately $615 million, or 2.0 percent, to $31.06 billion in fiscal 2021 according to a new forecast released today by the Massachusetts Taxpayers Foundation at the state’s annual consensus revenue hearing. The...

BUDGET & TAXES > Budget > FY 2021

Oct 16, 2019

BUDGET & TAXES > Budget > FY 2019

Though the Commonwealth’s fiscal year 2019 ended June 30th, decisionmakers must make several important choices before the final accounting of the state’s finances for the year can be completed. Most importantly, lawmakers will determine how to...

BUDGET & TAXES > Budget > FY 2019

Sep 30, 2019

BUDGET & TAXES > Budget > FY 2019

Though the Commonwealth’s fiscal year 2019 ended June 30th, decisionmakers must make several important decisions before the final accounting of the state’s finances for the year can be completed. Most importantly, lawmakers will determine how to...

BUDGET & TAXES > Budget > FY 2019

Aug 08, 2019

BUDGET & TAXES > Budget > FY 2019

The Commonwealth Stabilization Fund, the state’s “rainy day” fund, is a critical component of the Commonwealth’s financial structure. For example, amid the Great Recession in fiscal 2009, budgeted tax revenue plummeted by nearly $2.7 billion compared...

BUDGET & TAXES > Budget > FY 2019

Aug 02, 2019

BUDGET & TAXES > Budget > FY 2020

Governor Charlie Baker signed his fifth General Appropriations Act (GAA) on Wednesday, July 31, 2019, giving his approval to $43.6 billion in spending appropriations. While choosing not to exercise his veto authority to reduce spending, the Governor...

BUDGET & TAXES > Budget > FY 2020

Jul 22, 2019

BUDGET & TAXES > Budget > FY 2020

Massachusetts legislators released their compromise plan for the fiscal 2020 budget, authorizing $43.6 billion in spending for the fiscal year that began July 1, 2019. The six-member budget conference committee reconciled the differences between the...

BUDGET & TAXES > Budget > FY 2020