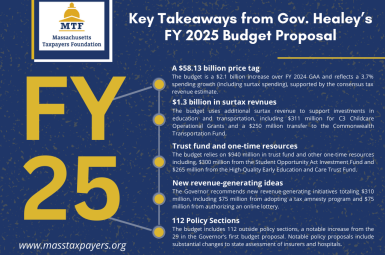

On January 24th, Governor Healey released her administration’s budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in childcare, healthcare, and transportation; as well as $20.3 billion in gross spending for the state’s MassHealth program.

Compared to FY 2024, gross state spending on MassHealth increases by $770 million or 3.9 percent; and the net cost of the program increases by approximately $279 million or 3.6 percent. In total, MassHealth accounts for 35 percent of overall spending in the Governor’s budget.